It’s all-change in the way company car tax is calculated from 6 April 2020. For drivers of zero and some ultra-low emissions company cars, this means some very big savings, so long as they use the right information. Jason Doran, Marketing Consultant from the Low Carbon Vehicle Partnership, explains

Thanks to new company car tax bands coming into effect from 6 April, running a low or zero-emissions company car has just become dramatically more desirable for the 2020/21 tax year – and could be the tipping-point moment many have been waiting for.

Drivers of zero-emissions models will now pay no benefit-in-kind tax whatsoever, down from 16% currently. On smaller electric cars such as the Renault Zoe, that equates to a £1,023 BIK tax saving for someone in the 20% tax bracket and a considerable £2,046 for a 40% taxpayer. If you are fortunate enough to be driving a more premium model, such as the Tesla Model 3 Performance, the annual savings are enormous: £1,806 for a 20% taxpayer, and £3,612 for 40%*.

Cars with CO2 emissions of 1-50g/km that are registered from 6 April 2020 will now pay between 0% and 12% BIK tax (also down from 16%). This is determined by not only the vehicle’s CO2 emissions, but also a new electric-only driving range figure.

Andy Eastlake, Managing Director of LowCVP, said: ‘For any company car drivers who have been thinking of switching to a low or zero-emissions car, now’s most definitely the time. These tax savings, on top of the already significantly lower running costs, make PHEVs and pure electric vehicles a compelling proposition. Actively encouraging company drivers is one of the fastest ways of transitioning our fleet towards the zero-emissions target.’

New WLTP CO2 numbers

Company cars registered from 6 April 2020 will use the new WLTP test procedure CO2 emissions number to determine the ‘benefit-in-kind’ tax payable. This replaces the previous less-realistic NEDC CO2 figure (which still applies for cars registered up to 5 April 2020).

As a result, this WLTP CO2 value is usually higher than before, even though the car’s emissions themselves have not changed. The benefit-in-kind tax bands have therefore been adjusted to allow for some of this. The WLTP CO2 figure also takes account of a vehicle’s specification and the options fitted – and so is specific to that car. It is therefore very important that company car drivers and fleet managers ensure they have this individual CO2 number, as it will be required for future annual tax returns.

Company Car Drivers of Plug-in Hybrid cars with WLTP CO2 emissions of 1-50g/km now also need to know their WLTP equivalent all-electric range (or zero emission mileage). This has not been asked for before. The higher the electric range, the less tax they pay. For example, a car with an electric range of 40 to 69 miles (registered from 6 April 2020) pays 6% BIK tax; but for an electric range of less than 30 miles, this doubles to 12%.

Again, cars registered up to 5th April will continue to use NEDC CO2 and NEDC electric range figures to determine the BIK payable.

Where do I find this new information?

A car’s CO2 figure is shown on the V5C registration document, or found by entering the registration number on the DVLA website: www.gov.uk/get-vehicle-information-from-dvla

Car leasing firms or fleet providers also supply this information – and should now begin to include a car’s official electric range too.

If you own the vehicle, both the equivalent all-electric range and CO2 figures can be found on the vehicle’s ‘Certificate of Conformity’; it’s therefore important you ensure this is provided with the car. If not, please talk to the supplier or manufacturer.

If, in extreme circumstances this information is not available, you can obtain the zero-emission mileage figure directly from the car manufacturer.

What a difference a day (or five) makes

It’s worth noting that, whilst new car CO2 officially switches from the old NEDC figure to the new WLTP CO2 emissions number on 1 April, this should not be used for BIK tax until 6 April. Instead, all company cars registered between 1-5 April 2020 must use the NEDC CO2 value for company car tax calculations. Thankfully this will still be on a vehicle’s Certificate of Conformity (CoC) document – although the same car’s V5C and general marketing literature, as well as the DVLA database, will be showing the new WLTP CO2 figure. Drivers and Fleet Managers need to be sure they’re using the correct number.

This all means that the company car tax a driver pays will depend upon which day the car is registered: if that’s on 5 April, they’ll be using the ‘old’ NEDC CO2 figure, which is likely to be lower than the new WLTP CO2 number that applies the day after. However, whilst that might sound like a great way of paying less, there are now two different sets of tax bands in place designed to take account of this.

At the end of the day, there will be winners and losers, depending upon how much a car’s official CO2 value has changed from NEDC to WLTP. Our advice, if you can, is to compare these two numbers for the car you’re interested in against the different tax rates payable. If there’s a big difference, then have a chat with your dealer or supplier about when you’d like the car to be registered.

Clearer showroom information

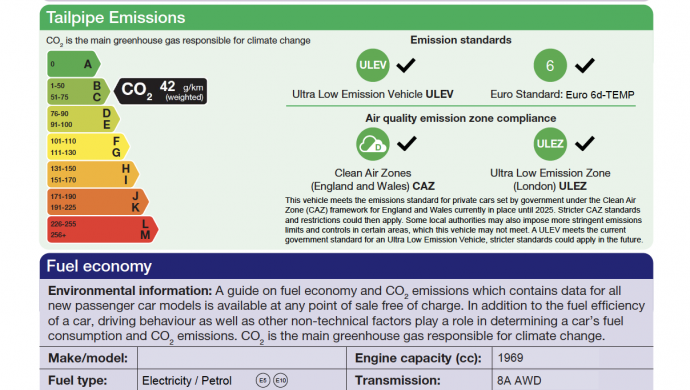

The immensely challenging times the country is currently facing means that, for now, visiting a dealership is not an option. However, once things begin to return to normal, this will continue to play an important role in helping company car drivers choose their next car, especially when they might now be considering switching to an electric or hybrid model for the first time. This is when the new car ‘environmental label’ (which you’ll find next to every new car on display) is invaluable for company car drivers. This label has been redesigned by LowCVP for the new WLTP regime and is now clearer, easier to follow and includes additional valuable information.

As well as the precise WLTP CO2 figure for the car on show, this label provides drivers with the official electric range for fully electric and plug-in hybrid cars, all of which influences the BIK tax they pay – a key part of their decision. There’s also information on how much the car could cost a month in fuel – or electricity – and the VED payable, all highlighting the potential massive differences in running costs.

Now’s the time to switch

The government has confirmed that zero-emission company car drivers will pay 0% BIK in 2020/21; rising to only 1% in 2021/22 and 2% the year after. This represents an enormous saving for drivers who are switching from a ‘conventional’ petrol or diesel, or who may have previously been put off a company car because of the tax burden. We are pretty sure at LowCVP that this will be as good as it gets for the foreseeable future.

If you’ve ever considered ‘going electric’, now is definitely the time to make the switch.

Further guidance

HMRC have issued further guidance for employers on reporting future company car tax data within their February 2020 ‘Employer Bulletin’

* Benefit in Kind tax saving calculations as follows:

Tesla Model 3 Performance: P11D price £56,435; BIK tax 2019-2020 rate 16% = £9,029.60. Cost for 40% tax payer £3,611.84 and for 20% tax payer £1,805.92. BIK tax 2020-2021 rate 0% = £0; savings of £3,611.84 / £1,805.92.

Renault Zoe R135 GT-Line: P11D price £31,965: BIK tax 2019-2020 rate 16% = £5,114.40. Cost for 40% tax payer £2,045.76 and for 20% tax payer £1,022.88. BIK tax 2020-2021 rate 0% = £0; savings of £2,045.76 / £1,022.88.